Forex Trading Results (Feb 2020)

- Matty Cheung

- Feb 25, 2021

- 4 min read

Updated: Feb 28, 2021

One year has passed since since February 2020 and what a year it has been.

There's been ups and there's been downs.

Volatility has been through the roof so we wanted to share with our traders and community the progress not only I've had, but our traders too.

One of those ideas was USD/MXN during February of 2020...

The idea started off by analysing the economics using the global macro strategy we follow here at Logikfx.

Fundamental Analysis Forex

Throughout the USDMXN idea, I went through some key fundamental analysis points going over:

Interest Rates

Gross Domestic Product (GDP)

Stock Market Analysis

Commodity Market Analysis

And finally the... macro currency strength meter

After the analysis I came up with the conclusion that USDMXN was looking like a great upside move... I was bullish.

This fundamental forex analysis really helped me filter out the market noise that I may have had trading using just technical analysis by itself.

I had the fundamental market direction and I was ready...

All that was left was to analyse two more factors:

Technical Analysis

Sentiment Analysis (COT REPORT)

Technical Analysis Forex

One of the main themes throughout the USDMXN technical analysis was the blatant uptrend that had been going on over the years.

I'm a simple man when it comes to technical analysis or price action... if going up I am bullish. If going down... I am bearish.

However, there were a few key areas on top of the standard price direction I considered.

One of them being "Support and Resistance" levels.

These were the support levels shown in the red lines above.

The good thing about the analysis was that I already filtered out the market noise using fundamental analysis.

I knew that... I only had to look for long positions and technical analysis that agrees with a long side move.

That's when it kicked in... saw majority of technical signs were bullish and took the trade.

After the technical analysis was in my favour I had one more step... analysing the hedge funds positions aka the Commitment of traders COT Report.

Sentiment Analysis Forex - COT Report

Forex traders way to analyse sentiment of the market is not looking at your brokers sentiment gauge or the sentiment meter you seen online.

The true way to analyse sentiment in the market is conducting COT Report Analysis.

The COT Report is a powerful and underutilized tool used by Forex traders to track what different market participants are doing.

When I was analysing the COT report for USDMXN I was looking for two main signals.

USD Hedge Fund Sentiment to be long

MXN Hedge Fund Sentiment to be short

The result....

Hedge funds were buying the US Dollar...great!

Mexican Pesos on the other than... they were also buying it!

So, in the end the sentiment of the market kind of cancelled itself out but slightly in favour of US Dollar due to the sheer open interest (amount of positions) they had in longs.

Great... the fundamentals were bullish, technical analysis were bullish and sentiment was semi-bullish.

Now the final step I took was to enter the position!

Using ATR to set Stops and Profit Targets

One of the main principles I had to follow was to make sure I set my stop losses and profit targets properly using the ATR calculator. This basically made sure that I wouldn't be stopped out straight away, a rookie mistake for most!

After placing the price data into the calculator it gave me a few key numbers which were interesting.

The average monthly volatility over the year was about 4% each month.

This mean my stop would be 4% wide.

The exchange rate sat at 18.7516... that meant by stop would be 17.9933!

My profit targets on the other hand would be at least 12% of the current price.

This would equate to a profit target of 21.0266!

Fast forward a few months and... BOOM!

Prices soared to over 25.5000! That's over a 30% gain!

These are the type of positions were about at Logikfx, big swings rather than lots of little trades. The opportunities may not come very often but they're are enough every year to make it worthwhile.

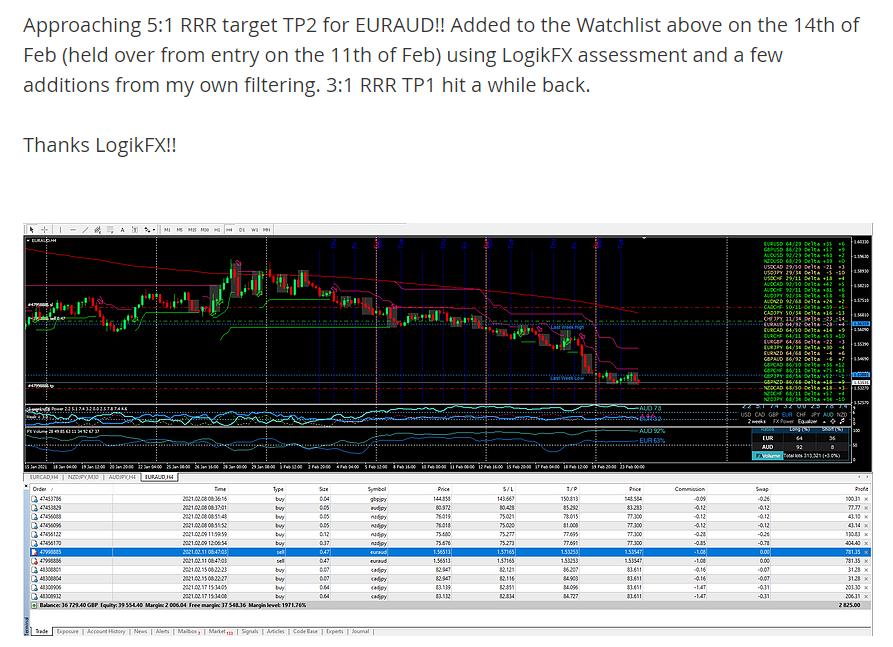

The start to 2021 has been amazing... lots of volatility in the markets and our traders utilising our strategy and technology have been paid dividends!

Just check out the forum to see for yourself.

Hope you enjoyed the results we had last year this time and maybe I'll see you in the community soon to join in on the fun!

Global Macro Strategy Forex Course

Learn through Logikfx Investment and Trading Academy (LITA) and take the first steps into growing your value as a trader with our free online courses, webinars, seminars. All from a small team of highly skilled traders with over 15 years’ experience in the financial markets. Learn how to make money trading forex, alongside the best ways to manage your risk through a proper trading journal, and sensible approaches to setting a stop loss (that doesn't get hit)!

Global Macro Strategy Technology

Already know how to trade? Save hundreds of hours each month on trading technology, analysis and research using Logikfx's Macro Technology in the LITA Portal. Computing thousands of fundamental reports for over 23 economic regions, you'll know accurate currency strength at the click of a button.

I highly recommend a particular trader to everyone looking for forex, crypto and Binary traders. In this period of economic crisis, Instead of going for a loan I decided to invest in Forex/bitcoins trading with Barry Silbert, After reading a lot of good reviews about him . I am glad to tell you that he is the only legit trader I know. I now make more than $6,099 a week. He can help you earn formidable profit weekly with his good trading strategies weekly, For more details, Contact Mr Barry Silbert on Email: Barrysilbert540@gmail .com

WhatsApp: +447508298691