GBPCHF Analysis (Nov, 2021) UK Xmas Boom?

- Matthew Cheung

- Nov 12, 2021

- 4 min read

The United Kingdom has been one of the worst hit by the pandemic over the past year... on top of this the supply chain issues caused by world wide shortages in staff, workers due to Brexit and inflation have all played a part in the economic concerns of the UK.

Year on year the UK hasn't managed to hit pre-crisis level growth rates, growing by 1.3%.

Not all is doom and gloom, we're seeing on a relational level that Switzerland may be facing even deeper concerns with UK economic data looking bullish in comparison.

The Logikfx technology summary is showing very positive early bullish signs towards GBP/CHF. The main indicators are bullish:

We'll also be analysing some key companies and commodities to assess relatively how well the GBP should be performing against the CHF.

Macro Currency Strength Meter

The macro currency strength meter has been showing bullish signs over the past 2 months. We can identify the GBP line has been in an uptrend over the past 6+ weeks whereas CHF has had an opposite downtrend. Overall, creating a currency strength meter crossover in favour of a bullish GBPCHF.

This allows us to fundamentally filter the markets and focus on bullish GBPCHF positions.

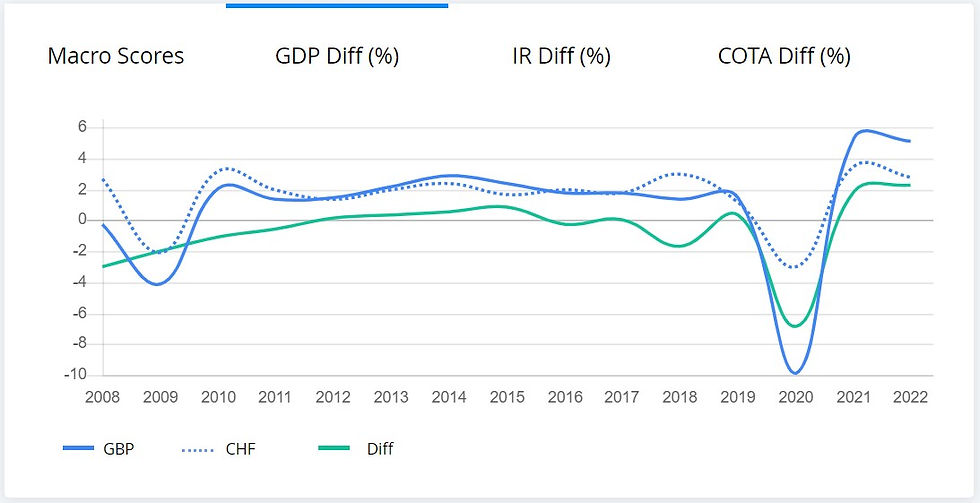

GDP Differentials

The GDP Differentials indicator display the difference in growth rates... what we've found since 2020 is that the UK is set to grow more than Switzerland moving into 2022. This is bullish for GBPCHF and also agrees with our fundamental outlook.

Trade Analysis (Imports vs Exports)

BRENT is a similar barometer to WTI but it's oil that's drilled and extracted from the North Sea, which the UK takes advantage of. What we've found is that over the past 10 years there's been over a 50% positive correlation between BRENT and GBPCHF showing as BRENT oil prices rise GBPCH generally follows and vice versa.

What we can take from this then is that most recently we're seeing oil prices rising significantly which is fairly bullish...however, prices are now at a level of potential resistance.

A slight dip in the prices has occurred since last month which makes the results slightly bearish.

Rolls Royce or the ticker RR is one UK's major engineering companies which makes sense to consider within the analysis as they're a major exporter of various parts such as engines.

"Rolls-Royce Holdings PLC is a United Kingdom-based engineering company. The Company is focused on power and propulsion systems. Its segments include Civil Aerospace, which is engaged in the development, manufacture, marketing and sales of commercial aero engines and aftermarket services; Defence Aerospace, which is engaged in the development, manufacture, marketing and sales of military aero engines and aftermarket services, and caters to sectors, including combat aircraft, trainer aircraft and helicopters; Power Systems, which is engaged in the development, manufacture, marketing and sales of reciprocating engines and power systems. Power Systems provides power solutions and complete life-cycle support under product and solution brand MTU systems." Investing.com

What we saw from last month is RR prices start to rise, prices have been rising for RR since last November. This agrees with our bullish analysis considering there may be a potential bullish move coming for GBPCHF that hasn't been realised.

Finally we've analysed gold prices which is a major component within both Swiss and UK exports/ imports... at one point the CHF had majority of their reserves in gold and even pegged their currency to the commodity!

What we've found over the past 10 years is a negative -40% correlation which suggests as gold prices rise GBPCHF falls.

Gold prices this past month rose whereas GBPCHF fell.

However, if gold prices continue to create lower lows and lower highs it's a potential sign that buyers of gold are starting to flatten out and that a downwards trend in gold may come soon.

Interest Rate Differentials

The interest rate differentials have been showing a positive differential since 2008 as Switzerland was one of the first countries in the world to implement negative interest rates. The current interest differentials suggest that the UK is actually better off to invest in as investors can earn interest on the GBP in comparison to negative rates in Switzerland.

Stock Market Analysis

The FTSE100 is a stock market index which tracks the performance of the UK's top 100 companies.

What we can gather from the analysis is that FTSE100 priced in CHF is still yet to reach the highs seen pre-pandemic meaning the UK is having a tough time growing.

This would be seen as potentially bearish for GBPCHF which is one of the indicators going against our fundamental analysis.

Hedge Fund Positioning

The Hedge Fund positioning is showing bullish signs...why?

What we can identify is that the hedge fund open interest is bullish because the blue line is above zero, meaning hedge funds are buying GBP.

On the flip side hedge funds have been selling the CHF since September!

This is a great sign that our idea is with the market and not against it on a sentiment level.

Price Trends

The price chart has shown GBPCHF selling off since the start of November...

Now that the fundamentals are potentially shifting to a bullish level and prices are starting to reach bullish areas we may see a reversal in the downtrend.

One for the watchlist to keep an eye on...

Learn to analyse the forex market using fundamental analysis, learn using our beginners course below:

Comments