EURMXN Analysis (Nov, 2022) Recession Signals

- Matthew Cheung

- Nov 9, 2022

- 4 min read

Since Russia are one of Germany's largest supplier of gas, switching this off would send gas prices through the roof meaning they've had to deal with political and economical issues of sanctions that were set against Russia which the people are now paying for.

"Markets expect the ECB to continue raising rates until the middle of next year, with a peak rate of around 3% from 1.5% currently." - Yahoo Finance

The forecast monetary policy shows that the central banks is set to combat this rising inflation but interest rates rising to 3% mid next year, is this enough? The United Kingdom has already increased borrowing to 3% as of this post...

More time will tell but inflation may yet be under control and I'm sure the authorities will take the necessary action if it continues to get out of hand... with a recession around the corner though the consumers are going to struggle in this coming year.

Logikfx Technology Summary

Throughout our analysis we'll be using the technology summary page to gauge at a high level what's going on with the fundamentals...

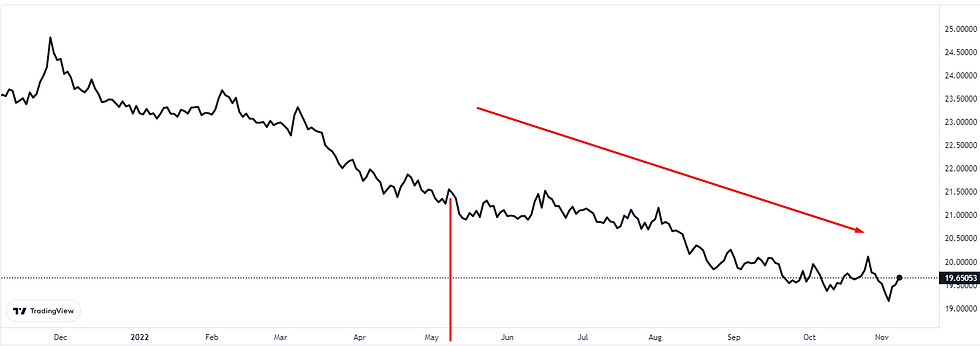

Similar to how we posted back in May this year on our previous EURMXN Analysis, we highlighted weak fundamental data and it suggested the fundamentals were bearish.

Fast forwards to today, you can see from the price chart that call was the start of a huge downwards trend...

Again, we're seeing similar signs we saw back in May suggesting the bears still in control.

All the major indicators below are negative suggesting weak fundamentals:

Macro currency strength meter

GDP differentials

Interest Rate differentials

Hedge Fund Positions

Now that we have our fundamentals in place, it's time to check across and take a deeper look at the sentiment, the technical and the other strong indicators to see if it supports this bias.

Macro Currency Strength Meter

The macro currency strength meter is one of the major fundamental indicators we account for when analysing a forex pair.

The currency strength meter is showing a clear differential between EURMXN. The European data releasing suggests bearish economic data is suggesting a negative economic climate in Europe and on the flip side suggesting Mexico is potentially better off in comparison...

Fundamentals are generally a strong indicator of trends and what the main market players use to generate their ideas. What we're trying to do here is align with the professionals using data.

The data thus suggests bears are in control and may be in control for a longer period of time.

GDP Differentials

The GDP Differentials are the long term indicator of economic growth.

What we've identified is that there's a forecast of the differential tightening suggesting that Europe is going to be growing at a much lower rate than Mexico...

This is another indicator within the analysis showing bearish signs... you can see the differential was on a rise between 2011 and 2020 but since then it has been dipping...

The exchange rate has followed a similar trajectory.

Trade Analysis (Imports/Exports)

WTI crude oil is a commodity we're looking to analyse against EURMXN, Mexico being a decently sized exporter of crude oil within the NAFTA countries.

What we've seen when comparing EURMXN against WTI is that when the prices of oil increases EURMXN falls...

This relationship has held true throughout the past year and recently we're seeing oil prices starting to pick up again suggesting a potential dip in EURMXN is expected.

Volkswagen is a major car manufacturer in the EU which exports vehicles globally in huge volumes... this has a huge impact on currency exchange rates as businesses like this need to trade in different countries currency. What we've found is a consistent positive relationship between VW and EURMXN.

VW has fallen throughout 2022 and has been on a downwards trend for a long period of time. If this trend is to continue we may see EURMXN follow suit.

Gold prices are another commodity we've chosen in the analysis as Gold is classed as a safe haven asset whereas Euro in comparison would be seen as riskier...

This makes sense as when the prices of gold rice we tend to see the prices of EURMXN fall...the most recent gold prices have hit a double bottom/ triple bottom suggesting safe haven asset of gold may be on the rise again!

This suggests EURMXN may be in a downwards trend again as we move close to 2023 as all the major commodities/ business performance indicators are suggesting a bearish move on EURMXN.

Interest Rate Differentials

The interest rate differentials are a strong indicator of money flows.

In this case we're seeing that Mexico have started to drastically increase their interest rates whereas Europe has looked to keep interest rates fairly low still at around 1.5% and forecast to reach only 3%...

Again, this is bearish for EURMXN as investors may seek to hold more MXNs for higher interest.

Hedge Fund Positions

The hedge fund positions are in an interest spot, the COT report shows that the overall open interest between EUR and MXN shows that they're buying both currencies but they have many more buy positions open for MXN in comparison to Euro which is sitting nearly neutral...

This negative open interest differentials suggests we may see a further downwards trend for EURMXN from a sentiment stand point.

Price Analysis

The overall price analysis is obvious, we are in a downwards trend for EURMXN and any bearish signs on a technical level may be a good sign to be in on that trend...

What we're seeing now is a potential pullback and continuation situation and EURMXN is definitely one to keep an eye on..

Comments